Step 1: Attend a Pre-Retirement Seminar

Watch the seminar now on YouTube or sign up for a live seminar.

Attend or watch this seminar if you haven’t already. This seminar covers a wealth of information about ACERA membership, retirement allowance benefit formulas, purchasing service credit, retirement allowance options, retiree health, dental, and vision coverage, and much more.

Step 2: Attend Your Ready-To-Retire Counseling Session

Step 2: Attend Your Ready-To-Retire Counseling Session

If you haven’t scheduled your Ready-To-Retire Counseling Session, go ahead and do that on our form:

Schedule Your Ready-To-Retire

Counseling Session

If you already have a Ready-To-Retire counseling session scheduled, you’ll meet one-on-one over the phone with a retirement specialist who will go over a retirement checklist, provide you retirement estimates, and give you important information.

If you don’t already have a counseling appointment scheduled, and you’re not going to have one because you’re ready to retire, you can email ACERA at info@acera.org with any questions you have, and you can skip to the next step.

Prior to your counseling session, complete the forms in the counseling packet below in order to make the most of your time with your counselor.

What to Expect During Your Counseling Session

Your retirement counselor will review a counseling checklist and ensure all forms and documents are submitted. They will also review your retirement allowance estimates and allowance options with you as well as answer any questions you may have regarding the process and your future retirement benefits.

Step 3: Decide on 1 of 5 Retirement Options

Step 3: Decide on 1 of 5 Retirement Options

On your retirement application, you will choose one of the five retirement options below. Each option specifies a retirement allowance and a death benefit.

Your selection is permanent and cannot be changed after you are retired—so it’s important to understand your benefits and your beneficiary’s benefits under each option.

Glossary

- Beneficiary: a person who receives benefits. An ACERA retiree’s beneficiary is a person the retiree designates to receive their death benefits upon the retiree’s death.

- Continuance: is a continuing monthly payment to a beneficiary or beneficiaries after an ACERA retiree dies.

- Continuance beneficiary: the beneficiary an ACERA member names to receive a continuance upon the retiree’s death. Members’ only opportunity to name a continuance beneficiary is at the time of retirement.

- Lump-sum payment: A one-time death benefit payment to a beneficiary. The beneficiary can be anyone, including a trust or a charity.

Unmodified Option

Maximum Retirement Allowance

60% Continuance to Beneficiary

|

Retirement Allowance to Retiree

|

Maximum allowance provided for retiree’s lifetime, based on age, service credit, and final average salary.

|

|

Beneficiary’s Benefit Upon Retiree’s Death

|

60% Monthly Continuance

- A spouse, state-registered domestic partner, or Alameda County domestic partner who entered marriage or domestic partnership at least 1 year before retirement will receive a lifetime monthly continuance of 60% of retiree’s allowance at time of death.

- If the retiree was on a service-connected disability retirement, the benefit is 100% of retiree’s retirement allowance at the time of death for a spouse, state-registered domestic partner, or Alameda County domestic partner who entered marriage or domestic partnership by the time of retirement.

- Or to minor children: monthly continuance of 60% (or 100% for member who retired on service-connected disability) of retiree’s allowance at time of death

- Can be one child or multiple children. Multiple children will share the collective 60% continuance.

- Continuance stops at age 18

- Or continuance stops at age 22 if child maintains full-time enrollment in an accredited school

- Continuance stops if they marry or register state domestic partner

Or Lump-Sum Payment to Anyone

- To beneficiary other than an eligible spouse, state-registered domestic partner, Alameda County domestic partner, or minor child: a one-time, lump-sum payment of retiree’s accumulated contributions and interest, minus total retirement payments already paid. If the retiree dies after the first 3-5 years of retirement, the lump sum amount will already be exhausted.

|

|

If Continuance Beneficiary Dies Before Retiree

|

Retiree can name a new beneficiary, but only for a lump-sum payment, not for a continuance.

|

Option 1

Lump Sum Benefit to Beneficiary

No Monthly Continuance

|

Retirement Allowance to Retiree

|

Slightly lower allowance for retiree’s lifetime than under unmodified option.

|

|

Beneficiary’s Benefit Upon Retiree’s Death

|

One-Time Lump-Sum Payment

Lump sum payment = employee contributions + interest – annuity portion of allowance already paid

|

|

Beneficiary Can Be

|

Anyone |

|

Special Considerations

|

- This option may leave a higher lump-sum balance to be paid to the beneficiary than under Unmodified Option because contribution balance is paid to the retiree at a slower rate. This option extends the time it takes under the unmodified Option (3–5 years) to exhaust the balance of contributions and interest to a range of 10–12 years.

- If all contributions and interest have been paid as of retiree’s death, there will be no balance remaining for the beneficiary.

- Retiree may name a new beneficiary at any time.

|

|

If Beneficiary Dies Before Retiree

|

Retiree can name a new beneficiary |

Option 2

100% Continuance to Beneficiary

|

Retirement Allowance to Retiree

|

- Lower allowance for retiree’s lifetime than under unmodified option

- Amount of reduction based on beneficiary’s age at time of member’s retirement

|

|

Beneficiary’s Benefit Upon Retiree’s Death

|

100% Monthly Continuance

Lifetime monthly allowance of 100% of retiree’s allowance at time of death

|

|

Beneficiary Can Be

|

Any one person |

|

Special Considerations

|

- Under California law, retiree’s spouse/state-registered domestic partner may have certain rights over any other designated beneficiary.

- If named beneficiary dies before retiree, retiree’s benefit will not be increased.

- If the beneficiary is more than 10 years younger than the retiree and they are not the retiree’s spouse, state-registered domestic partner, or Alameda County domestic partner, the beneficiary’s benefit may be less than 100% and will be limited based on the IRS Limit for Non-Spouse Beneficiaries.

|

| If Continuance Beneficiary Dies Before Retiree |

Retiree can name a new beneficiary, but only for a lump-sum payment of retiree’s accumulated contributions and interest, minus monthly payments already paid. No continuance will be available. |

Option 3

50% Continuance to Beneficiary

|

Retirement Allowance to Retiree

|

- Lower allowance for retiree’s lifetime than under unmodified option

- Amount of reduction based on beneficiary’s age at time of member’s retirement

- Retiree’s retirement allowance is more than Option 2 because the beneficiary will get less than in Option 2.

|

|

Beneficiary’s Benefit Upon Retiree’s Death

|

50% Monthly Continuance

Lifetime monthly allowance of 50% of retiree’s allowance at time of death.

|

|

Beneficiary Can Be

|

Any one person |

|

Special Considerations

|

- Under California law, retiree’s spouse/state-registered domestic partner may have certain rights over any other designated beneficiary.

- If named beneficiary dies before retiree, retiree’s benefit will not be increased.

- Retiree’s allowance may be sharply reduced if beneficiary is considerably younger than retiree.

|

| If Continuance Beneficiary Dies Before Retiree |

Retiree can name a new beneficiary, but only for a lump-sum payment of retiree’s accumulated contributions and interest, minus monthly payments already paid. No continuance will be available. |

Option 4

Retiree Specifies Continuance Amount to One or More Beneficiaries

|

Retirement Allowance to Retiree

|

- Lower allowance for retiree’s lifetime than under the unmodified option

- Amount of reduction based on youngest named beneficiary’s age at time of member’s retirement

|

|

Beneficiary’s Benefit Upon Retiree’s Death

|

Retiree Specifies $ or % Continuance to One or More Beneficiaries

Retiree can specify one or more beneficiaries for a lifetime continuance of any percentage or dollar amount equivalent to or less than 100% of the retiree’s pension benefit.

- Example 1: a retiree could leave a 25% lifetime continuance to one nephew.

- Example 2: a retiree could leave 50% to each of their two adult children.

- Example 3: a retiree could leave 30% to one adult child and 10% to a family friend.

|

|

Beneficiaries Can Be

|

Anyone |

|

Special Considerations

|

- Under California law, retiree’s spouse/state-registered domestic partner may have certain rights over any other designated beneficiary.

- If named beneficiaries die before retiree, retiree’s benefit will not be increased.

- May not be provided if retirement allowance is based on disability retirement.

- If the beneficiary is more than 10 years younger than the retiree and they are not the retiree’s spouse, state-registered domestic partner, or Alameda County domestic partner, the beneficiary’s benefit may be less than 100% and will be limited based on the IRS Limit for Non-Spouse Beneficiaries.

|

| If Continuance Beneficiary Dies Before Retiree |

Retiree can name a new beneficiary, but only for a lump-sum payment of retiree’s accumulated contributions and interest, minus monthly payments already paid. No continuance will be available. |

Step 4: Complete Your Retirement Packet

Your Retirement Application

In order to retire, you must submit a retirement application to ACERA. When you are within 90 days of your chosen retirement date, you may complete and submit an ACERA retirement application. Once you submit your application, we record your date of retirement in our database.

Once that date passes and you cash your first retirement check, you’re retired. If you change your mind between when you submit your application and your retirement date, email us a letter with your signature that you’d like us to take your application out of the system, and we’ll do that for you. You can do this up to the day before you retire.

Don’t Submit Your Application Earlier Than 90 Days Before Your Retirement Date!

We can’t accept your application early (more than 90 days before the retirement date you’ve written on your application). If you submit it early, we’ll have to send you a rejection letter, and you’ll have to re-submit it to us anyway.

Complete Your Retirement Packet

Complete all the forms in the packet labeled mandatory. If you are retiring with 10+ years of service credit, the Vision and Dental Enrollment Forms are mandatory. Also complete the optional forms that apply to you.

We recommend using the DocuSign E-Forms for the most efficient completion of your packet. DocuSign E-Forms are submitted completely electronically within the DocuSign platform. Simply click on the DocuSign E-Form link and DocuSign will guide you through completing your form.

If you’re using the manual PDF forms, you can type in your information using the form fields, but you should print your forms and sign them in pen. Then follow the instructions in the next step for how to submit your forms.

On your retirement application, consider joining one or both retiree associations.

Retirement Packet

| Item |

DocuSign E-Form |

Manual PDF Form |

Instructions |

| Retirement Application |

DocuSign |

|

Mandatory. Before you start, please have a scan or photo of a voided check available to upload in your retirement application. Please allow at least 1 hour to complete the application process.

See more information about your retirement application below.

|

|

Medical Plan Enrollment Form

|

DocuSign |

PDF |

Optional. If you’d like to enroll in an ACERA group medical plan |

| Kaiser Permanente Senior Advantage Enrollment Form |

DocuSign |

PDF |

Optional. If you’re Medicare-eligible and are enrolling in the Kaiser Permanente Senior Advantage Plan, you must fill this out in addition to the Medical Enrollment Form.

IMPORTANT IF USING DOCUSIGN: Upon receipt, ACERA will submit this form to Kaiser on your behalf. Kaiser will call you to confirm your electronic signature on this form. YOU MUST ANSWER THIS CALL. If you do not answer Kaiser’s call, you will have 7 days to return Kaiser’s Medicare Team’s call to confirm your requested enrollment. Kaiser’s Medicare Team can be reached at 877-251-1532.

TAKE NOTE: If you delay in responding to Kaiser’s Medicare Team, your effective date of insurance on ACERA’s Kaiser Senior Advantage Group Plan may be impacted.

|

|

Dental Plan Enrollment Form

|

DocuSign |

PDF |

Optional: Less than 10 years ACERA service credit

Mandatory: 10+ years ACERA service credit, but there is no cost for member’s monthly premium

|

|

Vision Plan Enrollment Form

|

DocuSign |

PDF |

Optional: Less than 10 years ACERA service credit

Mandatory: 10+ years ACERA service credit, but there is no cost for member’s monthly premium

|

| Medicare Part B Reimbursement Plan (MBRP) Application Form |

DocuSign |

PDF |

Optional. With 10+ years of ACERA service credit or a service-connected disability retirement, get reimbursed for the federal cost of Medicare Part B. More info on the MBRP page.

Before you start, have a scan or photo of your Medicare card available showing your Medicare Part B effective date to upload with the form.

|

| Affidavit of Dependent Eligibility |

DocuSign |

PDF |

Optional. Mandatory if you are electing coverage for your children (or other non-spouse dependents) age 19 through 25 or children age 26 and older if incapable of supporting themselves due to a mental or physical disability incurred prior to age 26 |

| Affidavit of Domestic Partnership |

|

PDF |

Optional. Mandatory if you are electing healthcare coverage for a domestic partner. Since this requires notarization, you can’t submit it through DocuSign. Follow the instructions below to submit your form. |

| Sample Check Stub |

|

PDF |

Informational. Nothing to complete. Please review the information. |

| 5 Retirement Allowance Options |

|

Link |

Informational. Nothing to complete. Please review the information. |

| Retiree Death Benefits |

|

Link |

Informational. Nothing to complete. Please review the information. |

| Welcome Letter for Retired Employees of Alameda County (REAC) retirement association |

|

PDF |

Informational. Nothing to complete. Please review the information. |

Step 5: Submit Your Application and All Required Supporting Documents

Step 5: Submit Your Application and All Required Supporting Documents

Submitting Forms

If submitting DocuSign E-Forms, simply submit the forms within the DocuSign platform.

If submitting manual PDF forms, choose one of the methods below.

Submitting Required Documents

Review the page Documents We Need Before You Retire. Submit any required documents that apply to you using one of the methods below

Methods For Submitting Form and Documents

Scan and Upload

1. Install the free Adobe Scan app on your smartphone, and use it to create a single PDF of all pages of your application plus documents (get it where you get your apps). Visit www.acera.org/scan for a tutorial. Or you can use a scanner to create a PDF.

2. Log in to your account. Click the Upload Documents link to upload your application. Or you can email it to info@acera.org.

Or Fax

Fax your application and documents to 510-268-9574.

Or Mail

Mail your application and documents to:

ACERA

475 14th Street, Suite 1000

Oakland, California 94612

Also Provide a Voided Check

If you’re using the manual PDF form, submit a voided check to go along with the direct deposit section of your retirement application (not a deposit slip). If using the DocuSign retirement application, you can upload a voided check within DocuSign, so you don’t need to submit it separately.

If you don’t have checks with your account, have your bank send you a letter with all of the following items, and email a copy of it to us:

- Bank letterhead

- Your full name

- Your full account number

- Routing number

- The type of account it is (checking or savings)

No Trust Accounts: ACERA will not deposit member’s monthly retirement allowance payable to a bank account in the name of a trust.

Step 6: Do These Few Things After You Submit Your Retirement Application and Before Your Retirement Date

Change your email address for your ACERA online account.

Your email address is your username for you online ACERA account. Next time you’re logged in to Web Member Services, go to Account Settings to change your email address from your work email to your personal email. This way, you can still use the password recovery feature if you forget your password during your retirement when you will no longer have access to your work email.

If you will be Medicare eligible upon retirement (age 65+), apply for Medicare in advance to receive Medicare benefits.

Apply for Medicare Part A (if you haven’t already) and Medicare Part B (you should only apply for part B after you stop working) in advance of your retirement to ensure that your medical benefits will uninterrupted. Read more on our Medicare page.

Notify your employer in writing of your Employment Separation Date.

ACERA does not notify your employer; it is up to you. You must provide a letter of resignation to your HR department before you can retire. It’s important that your letter state your Employment Separation Date as well as your Retirement Date. Use this template, though feel free to revise it for your specific situation:

Dear [Your Boss’ Name],

Please accept this letter as formal notification that I am resigning from my position with [Organization Name] and retiring. My Employment Separation Date, which is my last day on payroll, will be [date]. My Retirement Date, which is my first day of retirement, will be [date, at least the next day].

I’m grateful for my time working for [Organization Name]. While I look forward to enjoying my retirement, I will miss being part of the team and the organization.

Leading up to my departure, I’ll do everything possible to wrap up my duties and train other team members. Please let me know if there’s anything else I can do to aid the transition.

Sincerely,

[Your Name]

Here’s a Word Document version of the above letter that you can download and customize:

Letter of Resignation Template

For more information on your Employment Separation Date, review our Choose Your Retirement Date page.

Contact any agencies you have reciprocity with and apply to retire with each system.

If you have reciprocity with the pension systems of other California public agencies, contact each reciprocal agency and apply to retire with each agency. You must retire from all linked systems on the same day! So the retirement date on each retirement application for each pension system should be the same day. For more information on reciprocal retirement, see our Reciprocity page.

You must notify each system of your planned retirement date and remind the system that you are a reciprocal member. This will ensure all systems coordinate your effective date of retirement.

Here are a few final things to know about your upcoming retirement and lifetime retirement allowance.

Step 7: Understand a Few Things About Your Upcoming Retirement Allowance

Step 7: Understand a Few Things About Your Upcoming Retirement Allowance

Your First Retirement Check

Once your retirement date passes (the date you chose and wrote on your retirement application), you’re retired! Your first retirement check will be issued 45 days after your last employer paycheck. It will be a paper check you receive in the mail. You will receive a separate Benefit Confirmation letter explaining some of the specifics about your monthly lifetime pension from ACERA. Please note: This letter is sent separately from your first check.

In most cases, your first payment will be your full 100% retirement allowance amount. However, if there are any major issues with your file, such as missing documentation, divorce orders pending, late service credit purchase, etc., you may be paid 80% payments until all issues are resolved. Once resolved, your allowance will be adjusted and a retro amount will be paid for any payments you received under your final 100% payment amount.

You Will Receive Your Retirement Allowance Payments From ACERA Every Month for the Rest of Your Life

Retirement allowances are paid on a monthly basis, on the last business day of each month.

You Must Sign Up for Direct Deposit to Receive Your Monthly Retirement Allowance

ACERA mandates signing up for direct deposit, so that your monthly check will be deposited directly into your bank account. Direct deposit is easy, safe, and reliable, and can save you time and money. You will receive a monthly Electronic File Transfer (EFT) statement in the mail each month whenever you are paid through direct deposit. This process ensures the receipt of funds, especially in the case of a natural disaster, Post Office delivery delays, or theft. You provided information for direct deposit on your retirement application. Please note: ACERA cannot set up trust accounts for direct deposit.

You Can Expect an Annual Increase to Your Retirement Allowance Called a Cost of Living Adjustment (COLA)

A cost of living adjustment (COLA) is made annually in accordance with the changes in the Consumer Price Index (“CPI”) for the San Francisco Bay Area. Adjustments are made annually on April 1 for all retirees and payees. Allowances may be increased up to a maximum yearly limit of 3% for tier 1 and 3 members and 2% for tier 2 and 4 members. This is a vested benefit.

See the COLA page in the Retirees section for current COLA information.

ACERA also currently provides a non-guaranteed Supplemental COLA that maintains retirees’ purchasing power at no less than 85% of their original retirement allowance.

Expect to Pay Taxes (Unless You Move Outside the U.S.)

Your ACERA retirement benefit allowance may be subject to federal and state income tax. As a part of the retirement application process, you will complete IRS form W-4P (Withholding Certificate for Pension Annuity Payments). Be sure to read the instructions carefully, and consult your tax advisor if you have questions. You can update your CA tax withholding after your retirement at any time by completing a new Withholding Certificate for Pension or Annuity Payments.

Please note: ACERA is governed by the State of California, and thus cannot withhold state income tax for states other than California. If you are living in a state other than California, we strongly suggest consulting a tax advisor about any state tax you may owe.

Your ACERA income will be reported to you each year in January via a 1099-R form.

See our Tax Considerations page for more information.

Contact ACERA if you have questions.

Check our Contact Page for more information on how to contact us.

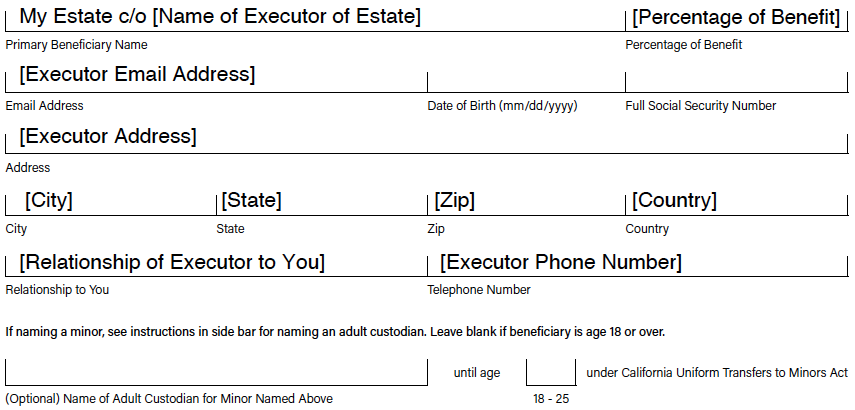

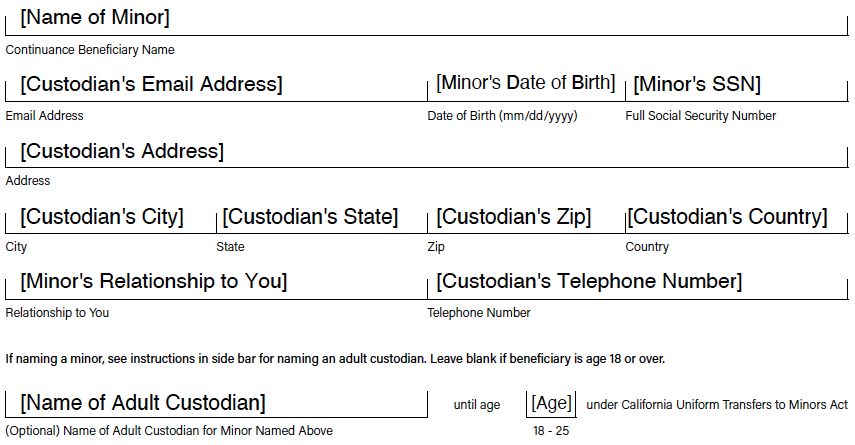

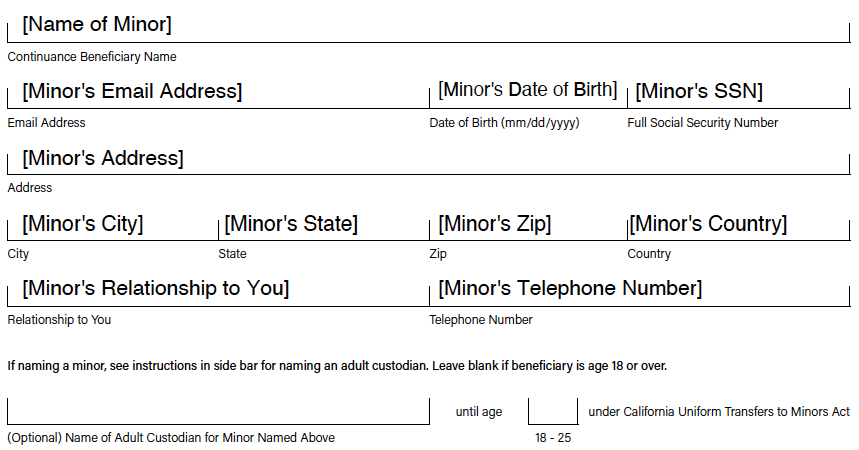

Special Instructions: Naming a Minor as a Beneficiary for a Continuance Death Benefit on Your Retirement Application or Beneficiary Form

With Naming an Adult Custodian

If your beneficiary is a minor and you wish to name an adult to receive and manage payments for the minor without court appointment or court supervision until an age you choose, use the format to name the beneficiary as shown in the image below.

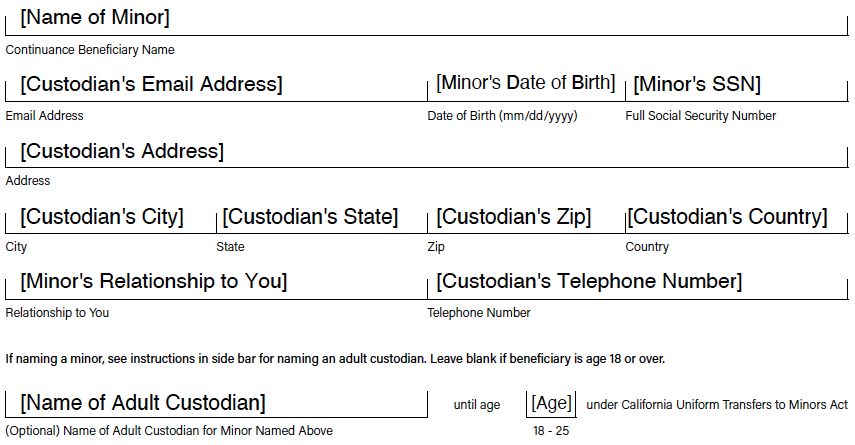

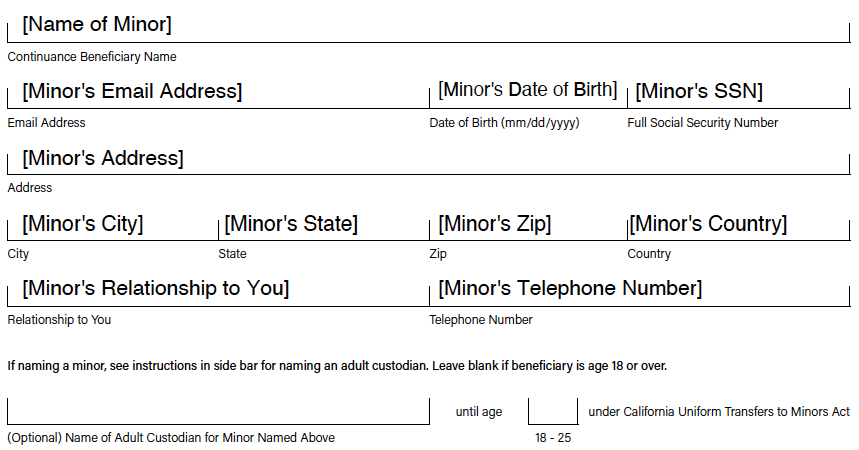

Without Naming an Adult Custodian

Alternatively, you may simply name the minor as beneficiary without naming a custodian, and all funds will be distributed to the beneficiary at age 18. For the beneficiary to receive funds before age 18, a court can appoint a custodian to supervise distribution of payments up to age 18. To do this, use the format as shown in the image below.

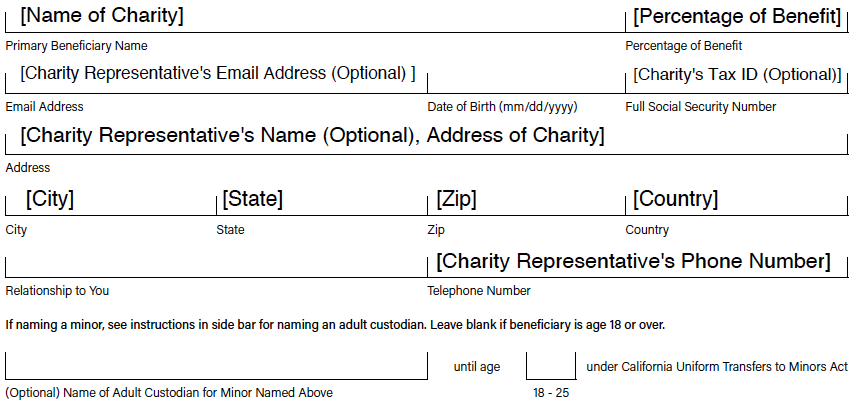

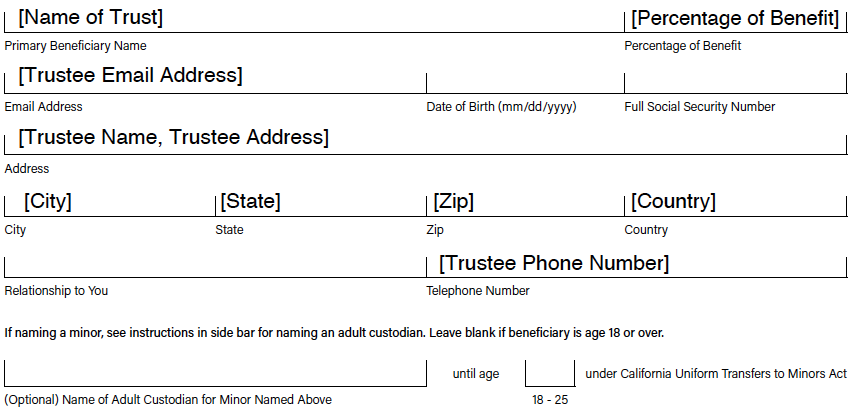

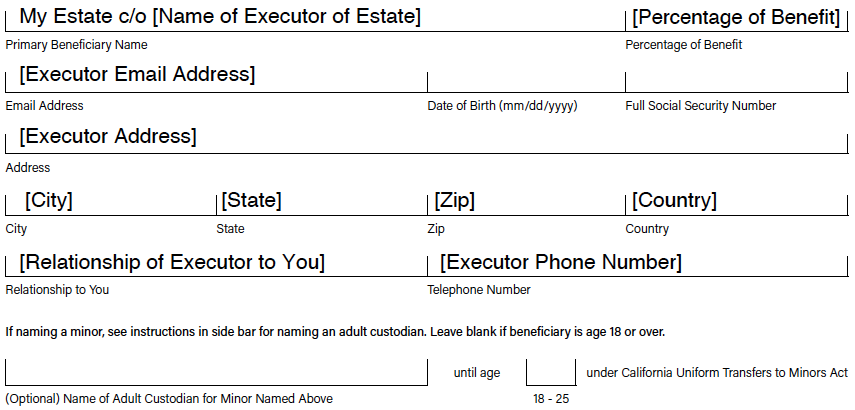

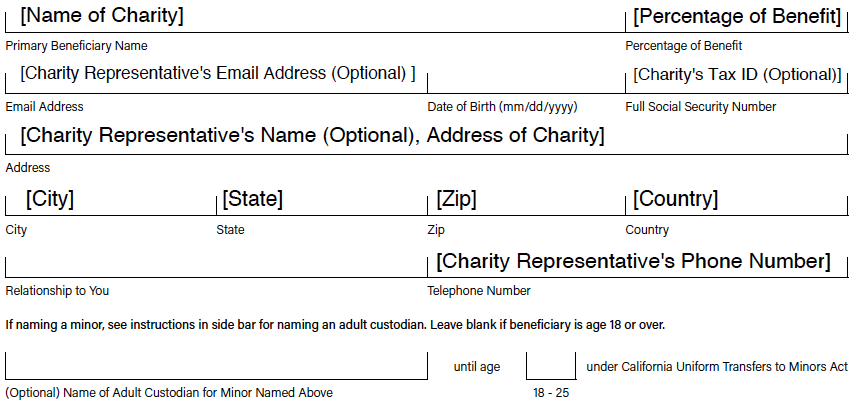

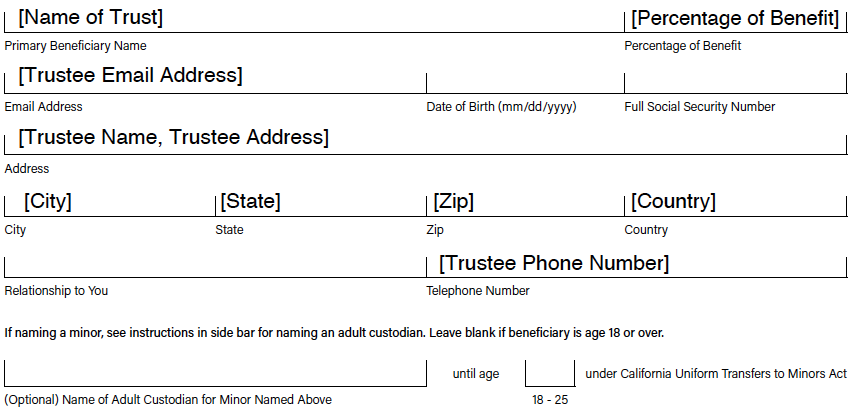

Special Instructions: Naming a Charity, a Trust, or Your Estate as a Beneficiary for Lump-Sum Death Benefits on Your Retirement Application or Beneficiary Form

Charity

Complete the beneficiary fields as shown in the image below.

Trust

Complete the beneficiary fields as shown in the image below.

Your Estate

Complete the beneficiary fields as shown in the image below.