Upon your death, benefits will be paid to your designated beneficiary(ies). Your spouse, domestic partner or unmarried child under age 18 (age 22 if a full-time student) may be able to elect allowances even if you do not designate them as your beneficiary and such elections will supersede the rights of all other designated beneficiaries.

Report a Death

Active Member Death Benefits

|

Benefit Options:

Upon Member’s Death, Eligible Beneficiaries Will Choose 1 Option:

|

Who Is Eligible: |

Beneficiary Can Be: |

|

1. Lump Sum

Return of employee contributions and accrued interest

PLUS

One month of salary for each year of service, not to exceed six months of salary

|

Beneficiaries of all members, except when a spouse, domestic partner or child has made an election per Option 2a, 2b, or 3 below. |

Anyone You Designate

You may designate percentages adding up to 100%. Benefits will be divided equally among designated beneficiaries if percentages are not specified. |

|

2a. Non-Service Connected Allowance

60% of the allowance you would have received if you retired for a non-service-connected disability on your date of death.

|

Beneficiaries of members with five or more years of service credit (ACERA and reciprocal combined) |

Spouse, State-Registered Domestic Partner, or Alameda County Domestic Partner

May elect the monthly allowance for their lifetime.

Eligible Children

If there is no surviving spouse or domestic partner, then unmarried children (natural or adopted) may elect a monthly allowance, to be divided equally among them. Each unmarried child’s allowance lasts until age 18 (age 22 if a full-time student). A court-appointed guardian must make the election for a minor child.

|

|

2b. Service-Connected Allowance

100% of the allowance you would have received if you retired for a service-connected disability on your date of death

|

Beneficiaries of all members |

|

3. Lump Sum / Allowance Combination

Combined benefit of a lump-sum and a reduced monthly allowance.

|

Beneficiaries eligible for Option 2a or Option 2b above. |

Extra Benefits for Some Beneficiaries of Safety Members

Spouses, domestic partners and unmarried children under age 18 (age 22 if full-time students) of Safety members who are “killed in the performance of duty or who dies as the result of an accident or an injury caused by external violence or physical force, incurred in the performance of the member’s duty” are entitled to additional benefits. Cal. Gov’t Code §§ 31787.5, 31787.6.

Reciprocal Members

For active members who had prior reciprocal service, in some cases death benefits paid to beneficiaries may be subject to a reduction so that the beneficiaries do not receive more from all systems combined than they could have received if all the member’s service had been with one system.

Installment Payments

For lump sum death benefits that include a return of amounts in the member’s account, instead of receiving payment in a lump sum, a beneficiary may elect to receive monthly installments over a period of up to ten years, with interest paid on the unpaid balance at ACERA’s annual inflation assumption, which is currently 2.75% per annum (compounded monthly).

Active Members Can Potentially Increase Benefits for Their Beneficiaries by Making an Advance Death Benefit Election

By making an Advance Death Benefit Election on the Active or Deferred Member Beneficiary Designation Form or the ACERA Welcome Form, you can potentially increase the benefits paid to your beneficiaries in the event you die before retirement as an Active ACERA member. ACERA’s Board made this option available on December 21, 2023. There is no disadvantage to making this election.

What Does the Advance Death Benefit Election Do?

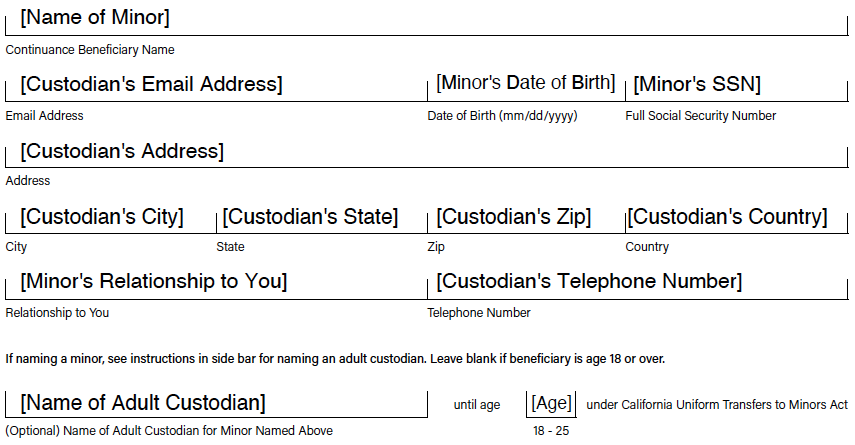

It allows you to pre-select an Optional Settlement 2 or Optional Settlement 4 continuance for your beneficiary in the event you die before retirement. Here is a comparison:

|

Comparison Between Beneficiary’s Benefit With and Without Advance Death Benefit Election

|

Advance Death Benefit Election?

|

Beneficiary’s Benefit

|

Beneficiary Can Be:

|

| No |

Non-Service-Connected Allowance

60% of the allowance you would have received if you retired for a non-service-connected disability on your date of death. |

Spouse, State-Registered Domestic Partner, or Alameda County Domestic Partner

(Lifetime allowance)

Or Unmarried Children

(If there’s no spouse or domestic partner) (only up to age 18 or age 22 if full-time student)

|

| Yes |

Optional Settlement 2

100% of the allowance you would have received from Retirement Option 2* |

Any one person

(Lifetime allowance)

|

| Yes |

Optional Settlement 4

100% of the allowance you would have received from Retirement Option 4 divided among multiple beneficiaries* |

Any two or more people

(Lifetime allowance)

|

*If the beneficiary is more than 10 years younger than the retiree and they are not the retiree’s spouse, state-registered domestic partner, or Alameda County domestic partner, the beneficiary’s benefit may be less than 100% and will be limited based on the IRS Limit for Non-Spouse Beneficiaries.

How to Submit an Advance Death Benefit Election

Simply download, complete, and submit the Active or Deferred Beneficiary Designation Form below, and make the Advance Death Benefit Election on the form. Follow the instructions on the last page of the PDF to submit the form.

Download the Form

For extra help on how to complete the form, watch this form walkthrough video:

After Making the Advance Death Benefit Election

An Advance Death Benefit Election can become automatically invalidated by certain events that occur after it is filed with ACERA. Also, certain events that do not automatically invalidate your Advance Death Benefit Election may warrant updating your beneficiary designations. Thus, members are strongly encouraged to file a new Active or Deferred Beneficiary Designation Form With an Advance Death Benefit Election after: a.) marriage or establishment of domestic partnership, b.) divorce or termination of domestic partnership, c.) birth or adoption of a child, d.) death of a designated beneficiary, and/or e.) any other life event that may cause you to reconsider your beneficiary designations.

Advance Death Benefit Election Frequently Asked Questions (FAQ)

How Does the Advance Death Benefit Election work?

At retirement, a member may elect Optional Settlement 2 or Optional Settlement 4, which allows the member to accept a lower allowance during the member’s lifetime in order to increase the benefits paid to the member’s designated beneficiaries after the member dies.

If a member has a permanent disabling condition that likely will lead to death, the member can increase benefits for the member’s beneficiaries by retiring for disability and electing Optional Settlement 2 or Optional Settlement 4. In some cases, though, a member who is eligible for a disability retirement may die before applying for retirement and electing an Optional Settlement. The Advance Death Benefit Election enables a member to direct ACERA, in advance, to retire the member for disability under Optional Settlement 2 or Optional Settlement 4 if the member later becomes eligible for a disability retirement before dying.

A member must have five years of service (ACERA and reciprocal combined) to apply for a non-service-connected disability. Thus, in the case of a non-service-connected death the Advance Death Benefit Election will only be effective if the member has five years of service at death. There is no minimum service credit required for a service-connected death, but the Board of Retirement must determine that the death was service-connected for such benefits to be granted.

How Does Optional Settlement 2 Work?

Optional Settlement 2 provides for an actuarially-reduced allowance for the member that continues, in full, to a single designated beneficiary for that beneficiary’s life after the member dies. The allowance must be actuarially equivalent to the member’s Unmodified allowance. Since the benefit is expected to be paid longer, the benefit must be lower than the Unmodified allowance (actuarially-reduced). The younger the beneficiary, the more the reduction must be.

In many cases, Optional Settlement 2 will provide a 100% continuance to the beneficiary. However, if the beneficiary is more than 10 years younger than the retiree and they are not the retiree’s spouse, state-registered domestic partner, or Alameda County domestic partner, the beneficiary’s benefit may be less than 100% and will be limited based on the IRS Limit for Non-Spouse Beneficiaries.

How Does Optional Settlement 4 Work?

Optional Settlement 4 provides for an actuarially-reduced allowance for the member that continues in specified percentages to the member’s designated beneficiaries for the rest of their lives after the member dies. The total cannot exceed 100% of the member’s benefit. To maximize benefits for beneficiaries on the Active or Deferred Beneficiary Designation Form, the member must specify percentages that add up to exactly 100%. The younger the beneficiaries are, the more the actuarial reduction to the total allowance will be.

If the beneficiary is more than 10 years younger than the retiree and they are not the retiree’s spouse, state-registered domestic partner, or Alameda County domestic partner, the beneficiary’s benefit may be less than 100% and will be limited based on the IRS Limit for Non-Spouse Beneficiaries.

Eligible Beneficiaries for the Advance Death Benefit Election: If you do not mark the Advance Death Benefit Election on your Active or Deferred Beneficiary Designation Form, only your spouse, domestic partner, or unmarried children under age 18 (age 22 if a full-time student) may receive a monthly allowance if you die while an Active Member. If you make the Advance Death Benefit Election, you may name other individuals, including children of any age.

Are There Disadvantages to Making the Advance Death Benefit Election?

No. In most cases, making the Advance Death Benefit Election will result in a higher allowance for your beneficiary(ies). If making the Advance Death Benefit Election will result in a lower allowance for a spouse or domestic partner (which is possible in some cases), your spouse or domestic partner may withdraw the disability retirement application before the Board grants the application. Thus, all members are encouraged to submit an Active or Deferred Beneficiary Designation Form and make the Advance Death Benefit Election on the form.

Download: Active Death Information Sheet

Active Death Information Sheet

Deferred Member Death Benefits

If your death occurs while you are in a deferred member status with ACERA (you are no longer working as an active ACERA member but are not yet retired), your beneficiary(ies) will receive a return of your retirement contributions plus interest as of the date of death. Beneficiaries of some deferred members may be eligible for additional benefits if either (a) the member dies while physically or mentally incapacitated for the performance of duty, if such incapacity has been continuous from discontinuance of service, or within one month after discontinuance of service, or (b) if the member has established reciprocity with reciprocal retirement system and dies while in service of the reciprocal employer.

Retiree Death Benefits

Retirees can name beneficiaries for four different kinds of benefits payable after the retiree’s death:

- Monthly continuance payments

- A one-time $1,000 lump-sum death benefit (as long as there are funds in the SRBR)

- Any retirement benefit allowance earned but not yet paid to the retiree at the time of the retiree’s death. This benefit covers the portion of the last month’s benefit payment payable for the portion of the month up to the retiree’s death (death pro-rated benefit)

- A refund of excess contributions if, when all monthly retirement payments have been made, the total payments made to the beneficiary are less than the retiree’s contributions and interest on deposit with ACERA.†

See Retiree Death Benefits page for more details on retiree death benefits.

† For these lump sum death benefits, rather than receiving payment in one lump sum, the beneficiary may elect to receive the payment in monthly installments over a period of up to ten years, with interest paid on the unpaid balance at ACERA’s annual inflation assumption rate, which is currently 2.75% per annum (compounded monthly).