Planning for retirement can bring up a lot of questions—maybe even a little anxiety. Take a deep breath. You’ve got this, and we’re here to help.

Start with our 20-minute video, This 20-Minute Check Could Change How You See Retirement, which walks you through the essentials in a clear, simple way.

If you prefer to move at your own pace, or want to dive deeper after the video, you can still follow the step-by-step guidance below. Do as many steps as you’d like now and come back anytime. Completing all of them will help set you on a strong, confident path toward retirement.

Step 1: Get an ACERA Estimate

Step 1: Get an ACERA Estimate

When you retire from ACERA, you’ll receive a pension allowance each month for the rest of your life. How much will you get? Here are 4 ways to get an estimate of your future monthly retirement allowance:

Option 1 (RECOMMENDED): Use the Benefit Estimate Calculator in Your Online Account

The most efficient way to get an accurate estimate of your ACERA lifetime retirement allowance is to use the retirement calculator in your ACERA account in Web Member Services.

| Log In To Your Account |

- Log in to your account. (Or click Enroll if you don’t have an account yet.)

|

|

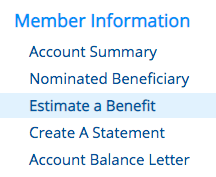

- Click on Estimate a Benefit.

|

|

|

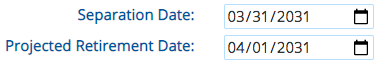

- Think of a retirement scenario, such as retiring 10 years from now. Based on your scenario, put in a projected date of separation (last day of work) and then a projected first day of retirement (at least the next day after your last day of work).

|

|

|

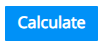

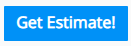

- Click Calculate, then click Get Estimate at the bottom, to get a PDF retirement benefit estimate.

|

|

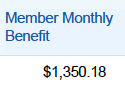

- The dollar amount next to Unmodified Option under Member Monthly Benefit is your maximum monthly pension allowance estimate in this scenario.

|

Option 2: Use an Income Replacement Chart for a Quick Ballpark Estimate

For a basic preview of what percentage of your highest salary your monthly pension allowance will replace, use these income replacement charts.

For a basic preview of what percentage of your highest salary your monthly pension allowance will replace, use these income replacement charts.

- Get a piece of scratch paper and something to write with.

- Think about what age your might retire at, and how many years of service credit you will have earned by that age.

Retirement Age:

Years of Service Credit at Retirement:

- Then click on your tier. Find where your retirement age and years of service credit intersect. This is your income replacement %.

General Members

Tier 1 Tier 2A Tier 3 Tier 4

Safety Members

Tiers 1 & 2B Tier 2C Tier 2D Tier 4

- Finally, multiply your income replacement % by how much gross salary you estimate you’ve earned per month during your period of highest pay:

Income Replacement % X Highest Average Monthly Salary = Ballpark Pension Estimate

Option 3: Use the Retirement Formula Worksheet

Use the Retirement Formula Worksheet to calculate an estimate. Download the Excel version:

Use the Retirement Formula Worksheet to calculate an estimate. Download the Excel version:

Retirement Formula Worksheet (Excel)

| Line |

Instruction |

Example |

Your Information |

| 1 |

Tier

Enter your tier.

|

Tier 2A |

|

| 2 |

Estimated age at retirement

Round down to nearest quarter age.

|

60.25 |

|

| 3 |

Age Factor Percentage

Enter the age factor percentage for your tier and age.

|

1.935% |

|

| 4 |

Years of Service Credit

Estimate your years of service credit at retirement; include partial years if you wish.

|

24.5 |

|

| 5 |

Highest Average Monthly Salary

Estimate your average salary during your final compensation period.

|

$5,000 |

|

| 6 |

Pension Allowance Estimate Subtotal

Multiply line 3 x line 4 x line 5.

If you’re a general tier 4 member or a safety member hired 1986 and later, stop here; this is your estimate. Everyone else should also complete the Social Security reduction calculation below.

|

$2,370.37 |

|

| |

Social Security Reduction Calculation |

|

|

| 7 |

Years of Service Credit from Line 4

|

24.5 |

|

| 8 |

Social Security Reduction Factor

Round your age in line 2 down to the nearest whole age, then choose the appropriate social security reduction factor from the table below based on your age.

|

2.24 |

|

| 9 |

Social Security Reduction Amount

Multiply line 7 x line 8.

|

$54.88 |

|

| 10 |

Pension Allowance Estimate With Social Security Reduction

Subtract line 9 from line 6. See notes below for why this is done.

|

$2,315.49 |

|

Social Security Reduction Calculation Notes

(General Tiers 1, 2, and 3 and Safety Members Hired Before 1986)

If you are a general member in tiers 1, 2, and 3, you participate in Social Security and will therefore have to have a slight reduction to your monthly allowance. This reduction is permanent, and will be included in all of your monthly retirement allowance payments from the beginning of your pension allowance payments. Safety members hired before 1986 will also need to do a calculation for any years they worked before 1986. (Tier 4 general members participate in social security, but this calculation does not apply.)

General members, put your total years of service credit (including partial year) at retirement in the worksheet. Safety members, put only your years worked prior to 1986 in the worksheet. Then find your Social Security Reduction Factor from the table below, and put that in the worksheet. Multiply the two figures together, and this tells you how many dollars to reduce your retirement allowance estimate by.

Social Security Reduction Factors

| Age Retired |

General Tiers 1 & 3 |

General Tier 2 |

Safety Tiers 1 & 2 |

| 41 |

– |

– |

1.46 |

| 42 |

– |

– |

1.546 |

| 43 |

– |

– |

1.634 |

| 44 |

– |

– |

1.726 |

| 45 |

– |

– |

1.821 |

| 46 |

– |

– |

1.919 |

| 47 |

– |

– |

2.025 |

| 48 |

– |

– |

2.12 |

| 49 |

– |

– |

2.222 |

| 50 |

1.559 |

1.38 |

2.333 |

| 51 |

1.646 |

1.45 |

2.454 |

| 52 |

1.739 |

1.52 |

2.585 |

| 53 |

1.839 |

1.59 |

2.728 |

| 54 |

1.947 |

1.66 |

2.878 |

| 55 |

2.065 |

1.74 |

3.056 |

| 56 |

2.193 |

1.82 |

3.056 |

| 57 |

2.333 |

1.91 |

3.056 |

| 58 |

2.437 |

2.01 |

3.056 |

| 59 |

2.578 |

2.12 |

3.056 |

| 60 |

2.726 |

2.24 |

3.056 |

| 61 |

2.885 |

2.32 |

3.056 |

| 62 |

3.055 |

2.44 |

3.056 |

| 63 |

3.055 |

2.56 |

3.056 |

| 64 |

3.055 |

2.7 |

3.056 |

| 65 & over |

3.055 |

2.84 |

3.056 |

Option 4: Request a Manual Retirement Estimate

You can request a manual retirement estimate by completing the Retirement Estimate Request form. Due to limited staff resources, manual estimates may take up to 90 days to complete.

Step 2: Understand Your Future Retirement Income

Let’s take a peek into your future. In retirement, you’ll need income to live off of to replace the income you were earning by working. Retirement income falls into 3 categories—pensions, Social Security, and savings/investments:

ACERA Monthly Pension

Social Security

+ Savings and Investments

= 80% of Salary

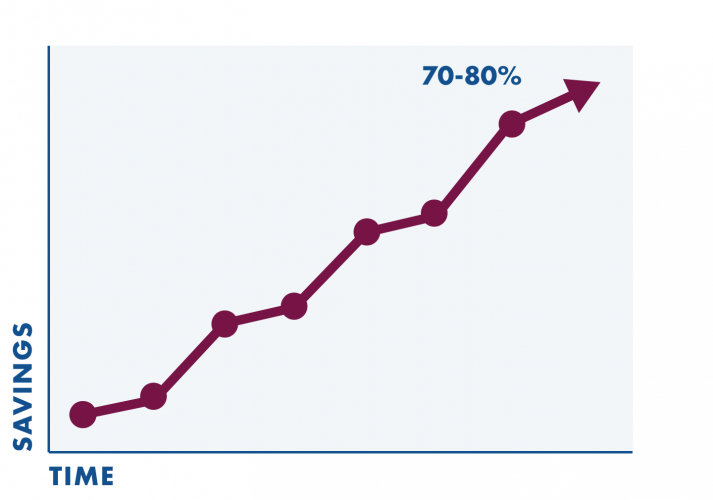

The picture above represents all your income during retirement, unless you continue to have a side job in retirement. The bottom line summarizes what financial planners often advise about your retirement savings: in order to maintain a similar standard of living to what you enjoyed prior to retirement, you will need to have an income that is at least 80% of what you were bringing in while you were working. The reason it’s not 100% is because of the assumption that you’ll have less expenses when you’re no longer working—you won’t have to buy work clothes or takeout lunches, spend money commuting, or pay into ACERA or Social Security.

In the next steps, we’ll show you how to adjust your savings/investments now so that you can hit that 80% target by the time you’re ready to retire. Have a pen and paper handy to make notes.

Step 3: Get a Social Security Estimate

Step 3: Get a Social Security Estimate

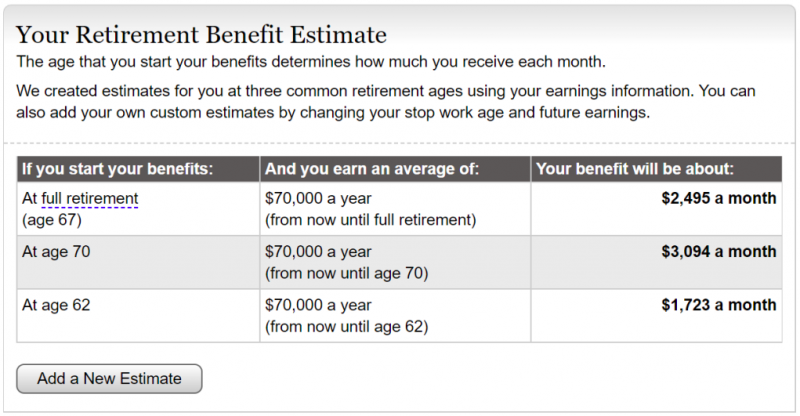

If you’ve paid into Social Security for at least 10 full time or equivalent years (see qualifications), you will get to collect a monthly payment from Social Security when you become eligible. Get an estimate of your monthly payment:

Social Security Estimator

An important thing to remember with Social Security is you may not become eligible to start collecting Social Security until some time after you retire from ACERA. Depending on when you were born, you can begin to collect a partial Social Security retirement at age 62 and the full Social Security retirement at ages ranging from 65 to 67.

When Can You Collect Social SecuritY?

Step 4: Calculate How Much to Save

Step 4: Calculate How Much to Save

Once you’ve calculated estimates of the payments you may receive from your ACERA pension and Social Security, you can estimate how much additional (if any) you need to save to hit the target of achieving 80% income replacement in retirement.

Estimate how much additional to save by utilizing the many retirement calculators available online. The most useful ones allow you to include your ACERA pension and your Social Security estimate. Each of these will give you somewhat different answers, so try a few of them:

Vanguard Calculator Vanguard Calculator Instructions

Charles Schwab Calculator

T. Rowe Price Calculator

Kiplinger Calculator

If you’re with the County, First 5, the Courts, or AHS and you already have a 457(b) account, also try the Empower retirement calculator in your Empower account.

Empower Retirement Calculator

These calculators should give you an idea of how much to save per month out of your paycheck to hit that target of adequate income replacement by the time you retire. Essentially, they’ll finish the equation for you. They’ll all give you slightly different numbers, so you could be conservative and just choose the highest savings amount, or you could take an average of them, or just save what you can for now.

Include Estimates of Other Pension Allowances You May Have

If you worked for other employers with pension plans (CalPERS, for example) that you expect to get pension allowance payments from when you retire, you should get estimates from those pension plans as well (their estimates aren’t included in your ACERA estimate, even if you have reciprocity). They may have online estimators like ACERA does, or you may need to give them a call and request estimates for the same dates as the estimates you got from ACERA. Add those estimates to your ACERA pension estimate when you’re using the retirement savings calculators.

Step 5: Determine Where to Save Your Money

Please note: You are responsible for your own investment risk. ACERA is providing this information to educate you on some retirement savings options, but you are ultimately responsible for any risk you take with your money.

Keeping your money in financial instruments that can earn you interest (rather than in your secret hiding spot at your house) can help you beat inflation, and can also help your money increase through the power of compound interest.

When you put your money into a financial instrument, you’re loaning your money to companies and/or governments so they can enhance their businesses; if their endeavors go well, they’ll pay you an investment return, also know as interest, for the use of your money.

Here are a few options for places to keep and/or invest your savings:

457(b) Deferred Compensation Account

Through your employer’s deferred compensation program, you can put pre-tax money away into a professionally managed, interest-bearing 457(b) account that’s invested in mutual funds or other broad investments of your choosing. You choose what you want to invest in among a variety of options, so you choose the level of risk appropriate for you. The fees are quite low compared to investments you might find on your own because you’re gaining a financial advantage from pooling your money with thousands of other county employees. And you can even set it up through payroll deductions, so you don’t even have to think about it. See the Deferred Compensation section below for more information.

Lower Risk Savings Options

If you’ve maxed out how much can contribute to your 457(b) account (good for you!) or you’re just looking for another place to keep your money, here are some options that are considered low risk. Four of the options are FDIC Insured, which means that deposits in these accounts are insured by the U.S. government for deposits up to $250,000 if your bank ever becomes insolvent.

| |

Financial Instrument |

FDIC Insured? |

Description |

| 1 |

High-Interest Checking Accounts |

Yes |

These are the same as regular checking accounts, but they’re offered by banks—often internet-only banks—that incentivize you to join their bank by paying you interest on your checking account balance, something most banks don’t do. If offered by an internet-only bank, you sacrifice the ability to get in-person help in a branch for the ability to earn interest. More info at Nerdwallet. |

| 2 |

High-Yield Savings Accounts |

Yes |

These are the same as regular savings accounts, but they’re offered by banks that incentivize you to join their bank by paying you a much higher level of interest on your savings account balance than most banks. These differ from checking accounts because you’re limited by federal law to only 6 withdrawals per month (of any amount), plus these accounts don’t come with checks or bank cards. More info at Nerdwallet. |

| 3 |

Money Market (Deposit) Accounts |

Yes |

These are similar to savings accounts where you can make a maximum of 6 withdrawals per month, but come with some features of a checking account like the ability to write checks and make purchases with a bank card. More info at Nerdwallet. |

| 4 |

Money Market (Mutual) Funds |

No |

Not to be confused with Money Market Deposit Accounts, these are mutual funds that invest only in highly liquid near-term instruments such as cash, cash equivalent securities, and high credit rating debt-based securities with a short-term, maturity—less than 13 months, such as U.S. Treasuries. As a result, these funds offer high liquidity with a very low level of risk. You can buy into them by opening up a brokerage account at the company that is offering the fund. Note that your account balance is not FDIC insured, so there may be some risk that you should research before investing. More info at Nerdwallet. |

| 5 |

Certificates of Deposit (CDs) |

Yes |

These are accounts with a bank that have a fixed interest rate and fixed date of withdrawal, known as the maturity date. By locking your money into one of these accounts for a fixed term, a bank will pay you interest for their use of your money. Terms typically stretch for 1, 3, or 5 years. Your money isn’t technically locked away, as you could withdraw it in an emergency and pay an interest penalty. More info at Nerdwallet. |

| 6 |

Treasury Bills and Notes |

No, but backed by U.S. Govt. |

U.S. government bills or notes are backed by the full faith and credit of the U.S. government. Bills are sold at a discount; when the bill matures, it will be worth its full face value. The difference between the purchase price and the face value is the interest. Notes are issued with maturities of 2, 3, 5, 7, and 10 years, and earn a fixed rate of interest every six months. In addition to interest, if purchased at a discount, T-notes can be cashed in for the face value at maturity. More info at Investopedia. |

| 7 |

Bonds |

No |

When you buy a bond you lend a government or business money for a set period of time, with the promise of repayment of that money plus a fixed rate of interest. More info at Nerdwallet. |

Moderate Risk Options

Index Funds

Index funds are a diversified, low cost way to invest in the stock market. When you buy into an index fund, you get a diversified selection of many stocks in one package without having to buy individual stocks. Because these funds simply hold all the stocks in a particular index, management fees tend to be low because there’s no need for fund managers to spend money on stock picking. For example, the Vanguard S&P 500 ETF (VOO) invests in the 500 stocks that are part of the S&P 500 stock index, which is made up of many of the largest public companies in the world.

Index fund risk is mitigated by the diversification of investments—the idea is that if one or a few individual stocks in companies in the fund lose money, the majority of the rest of the stocks won’t (barring extraordinary conditions like a recession). You’re essentially abiding by the age-old advice of not putting all your eggs in one basket.

Just remember that any time you’re putting your money in investments that aren’t backed by the FDIC or by major government entities (such as treasury bills/notes or government bonds) you’re increasing the amount of risk you’re exposing your money to—there’s a chance that if what you invest in loses money, your investments might lose value.

When people talk about mitigating risk by using index funds, they’re talking about long-term investing over many years, usually decades—stock prices in general tend to increase over long periods of time despite short term ups and downs in prices; if you invest and hold onto your investments for decades, their value tends to be much higher when you’re ready to cash them in to pay for your life in retirement, which means you made money. If you’re considering investing for short term gains, remember that your risk of losing money goes way up because the value of your investments might decrease in the short term, and you might be forced to sell them at a loss if you need the money. This is especially true during times of recession and high volatility, like the worldwide COVID-19 pandemic.

There are two types of funds you can buy into, Mutual Funds and Exchange Traded Funds (ETFs). There are two major differences between Mutual Funds and ETFs: minimum buy in and price timing.

| Fund Type |

Minimum Buy In |

Price Timing |

How to Buy In |

| Mutual Funds |

Sometimes $0, but often a few thousand dollars |

No real-time pricing. Priced at the end of each day. If you sell your investment, you get the price all the other investors get at the end of the day. |

Open a brokerage account with the company that runs the fund, e.g., open an account with Vanguard to buy into a Vanguard mutual fund. |

| Exchange Traded Funds (ETFs) |

The price of 1 share at the time you buy it, often $100-$300 |

Real-time pricing during trading hours. If you sell during trading hours, you’ll sell for the trading price at the moment you’re trading. |

Open a brokerage account with the brokerage company of your choice. For example, Robinhood offers commission free trading. |

Read more:

Robo Advisors

Robo advisors use complex algorithms to choose a diverse set of investments (usually indexed ETFs) for your portfolio based on risk preferences you specify. There’s typically no minimum buy-in amount. And because algorithms are choosing and rebalancing your portfolio rather than people, fees tend to be fairly low, often around 0.25% of assets under management annually. Two of the more well known robo advisor companies are Betterment and Wealthfront.

Read more:

Other Notable Retirement Accounts

Just like putting your money in a 457(b) account as described above, there are a variety of other types of retirement savings accounts approved by the IRS, including:

| Account |

Who can participate? |

| IRA |

Almost anyone |

| Roth IRA |

Almost anyone |

| 403(b) |

Educators, non-profit employees, and some healthcare workers |

| 401(k) |

Corporate employees |

| TSP |

Federal employees |

All of these types of defined contribution accounts, except for the Roth IRA, are tax-deferred, which means putting money in these accounts lowers your tax liability (the amount of income you owe income taxes on) during the year(s) you contribute. When you put your money in these accounts, you choose the types of investments that your money goes to, and therefore, you choose the amount of risk you are willing to take with your money. Many of these types of accounts will allow you to split your money among low and moderate risk options; for example, you could choose to put part of your money in FDIC-insured CDs, part of it in U.S. Treasury Bills, and part of it in Mutual Funds.

As a municipal government employee who already has access to a 457(b) account, an IRA is the other type of retirement account in which you can save pre-tax dollars. If you’ve already maxed out your 457(b) account for the year, you can put additional money in an IRA, although there are a few rules and restrictions. Alameda Health System employees also have access to 403(b) accounts. Checkout this Nerdwallet article on How and Where to Open an IRA.

If you have one of the other types of accounts from previous employment, you can usually roll over you money into your 457(b) account if you think you can get a better return in the 457(b) program. Contact your 457(b) representative for more information on how to do this and whether it’s a good idea or not.

High Risk Options

Investment opportunities other than what we’ve outlined above may be very risky. Be especially wary of investing in individual stocks! This is a high-risk way of investing and even professional investment managers with decades of experience have mixed results picking the right individual stocks!

Watch Out For Investment Scams

Investment scammers would love to take your money and leave you with nothing. Check out these articles on how to avoid investment scams.

Financial Mentor: Top 26 Warning Signs Of Investment Fraud

The Street: Investment Scams Every Investor Must Know How to Spot

Forbes: Too Good To Be True? How To Spot Investment Fraud

Step 6: Start a 457(b) Deferred Compensation Account

Step 6: Start a 457(b) Deferred Compensation Account

A 457(b) account is a tax-advantaged account offered to state and local public employees to save for retirement.

People use the term “deferred compensation” when talking about 457(b) and other types of retirement savings accounts because when you have money taken out of your paycheck to put in one of these accounts, you are effectively deferring the compensation you would have received today while you work until later, usually saving it for when you retire.

And you get to save on a pre-tax basis: the money you put in your 457(b) account comes out of your pay check before tax withholding is calculated and taken out of your paycheck, and you won’t owe taxes on the money you contribute to the account each year. Saving money in your 457(b) account lowers your tax liability, which is the amount of income you owe income taxes on. You pay less taxes now, though you’ll pay taxes on withdrawals from the account later on in retirement.

When you retire and begin withdrawing money from these accounts to pay for your life in retirement, that will be considered income, and you’ll have to pay income taxes then because you didn’t pay income taxes on that money yet. But this is typically advantageous to you for 2 reasons:

- Your income will likely be lower in retirement, which means you’ll probably be in lower tax brackets and pay at lower rates than if you would have had to pay income taxes on receiving that same money while you were working.

- Because you don’t pay income taxes on your money yet, this leaves a higher balance in your retirement savings accounts to be exposed to the power of compound interest. Compound interest can be thought of as “interest on interest” which will make your money grow at a faster rate than simple interest. Over time, this gives you the potential to earn more money than if you had paid income taxes on that income initially.

How to Start a 457(b) Account

As public employees, you have access to open deferred compensation accounts to save money for retirement. You can start with as little as a $20 per pay period contribution. Here’s how to start an account.

| You Work For |

Your Options |

Account Administrator |

How to Get More Info or Start an Account |

|

Alameda County

|

457(b) |

Empower |

More info and sign up here. |

| First 5 Alameda County |

457(b) |

Empower |

Sign up with and get more info from Lyssa DeGolia. |

| The Superior Court |

457(b) |

Empower |

Sign up with Dwana Black. More info here. |

| Alameda Health System |

457(b)

403(b)

|

Empower |

Check out Investopedia for a comparison of 457(b) and 403(b). Get more info and sign up with Alison Drummer. |

| Livermore Area Recreation and Park District (LARPD) |

457(b) |

MassMutual |

Sign up with Julie Dreher. Contact David McCray for more info. |

| Housing Authority of the County of Alameda |

457(b) |

ICMA-RC |

Sign up with your Human Resources Department. Contact Habib Mbye for more info. |

Get Free Financial Guidance From Your Deferred Compensation Plan Representative

If you enroll in your employer’s deferred compensation program, you get free access to licensed financial guidance professionals. They function as record keeper and are responsible for processing all participant transactions. Use the contract information above to get guidance.

Step 7: Make It Easy With Payroll Deductions

Step 7: Make It Easy With Payroll Deductions

Once you have a ballpark estimate of how much additional money to save from your paycheck, the easiest way of helping you stick with your savings plan is by setting up a payroll deduction and/or an automatic transfer.

Payroll Deduction: When you open a deferred compensation account like a 457(b), a deferred compensation representative will set up an automatic payroll deduction for you, which means money will automatically be taken out of your paycheck and transferred to your deferred compensation account. At first you’ll notice a bite taken out of your paycheck, but after a few paychecks your new take home pay will be the new normal—you’ll adjust your spending and you’ll be well on your way to a healthy retirement savings.

Automatic Transfer: For investments beyond deferred compensation accounts, banks and investment managers will typically help you set up a periodic automatic transfer from your checking account to your savings and other investment accounts. You can even set it to happen on payday so you won’t even see the money in your checking account and be tempted to spend it.

You’re Done!

Nice job! Now that you’ve projected how much additional to save for retirement and have created a payroll deduction to your deferred comp account and/or set up an auto transfer to your savings/investments accounts, you don’t need to do anything else for now. Anxiety crisis averted. But go ahead and read step 8 because you’ll need to check back periodically to adjust your retirement savings trajectory.

Step 8: Check Your Trajectory Periodically

Step 8: Check Your Trajectory Periodically

Check your trajectory periodically by redoing the steps above every 1 year or even every 6 months. Since predicting the future is not an exact science, no retirement savings calculator will be able to give you the exact retirement savings amount you need to target. What they will do it get you pointed in the right direction. When you redo the calculator in a year, maybe your trajectory is off a bit, where it’s not quite pointed at 80% income replacement. That is your opportunity to re-adjust your trajectory to get point at 80% again. By the time you reach retirement, you’ll be in the neighborhood of 80% income replacement.

Extra Credit: Learn More on Retirement Planning and How to Reduce Your Expenses

Read More on Retirement Planning and Massively Cutting Your Expenses

Understand What Factors Make Up Your ACERA Retirement

In general, you get a higher retirement allowance by working more years, earning a higher salary, and being older when you retire (although there are limits). In order to maximize your ACERA retirement allowance, learn more about how your ACERA Retirement Allowance is calculated and other details of your membership in ACERA.

Purchase Service Credit if You Have Eligible Time

Depending on your situation, it could be especially important to consider purchasing service credit if you have time that is eligible for purchase, such as part time work, TAP time, or unpaid leave time. Purchasing service credit increases your retirement allowance. The longer you wait to purchase service credit, the more expensive it gets, due to interest accruals, so act soon.

Understand Qualifications for Healthcare Subsidies

You may be eligible for additional retirement benefits such as healthcare subsidies to help you pay for the cost of healthcare in retirement. Qualification for the subsidies starts at 10 years of ACERA service credit. Also, when you’re approaching retirement, it’s a good idea to understand the healthcare costs (including vision and dental plans) and subsidy amounts so you can understand how much of your retirement income needs to budgeted for healthcare costs. See our Healthcare & Other Benefits page for more info.

Get Financial Guidance From Your Deferred Compensation Plan Representative

If you enroll in the your employer’s deferred compensation program, you get free access to licensed financial guidance professionals. They function as record keeper and are responsible for processing all participant transactions. See the Deferred Compensation section above for more information.

Get Financial Guidance From 1st United Credit Union

1st United Credit Union was created by county employees, for county employees. If you open an account with them, you can access their free licensed financial advisors to help you set a course for additional retirement savings. They also offer a web app called 1st Money Manager, where you can connect data from all of your financial accounts to help you see your overall financial picture. Visit 1st United Credit Union.